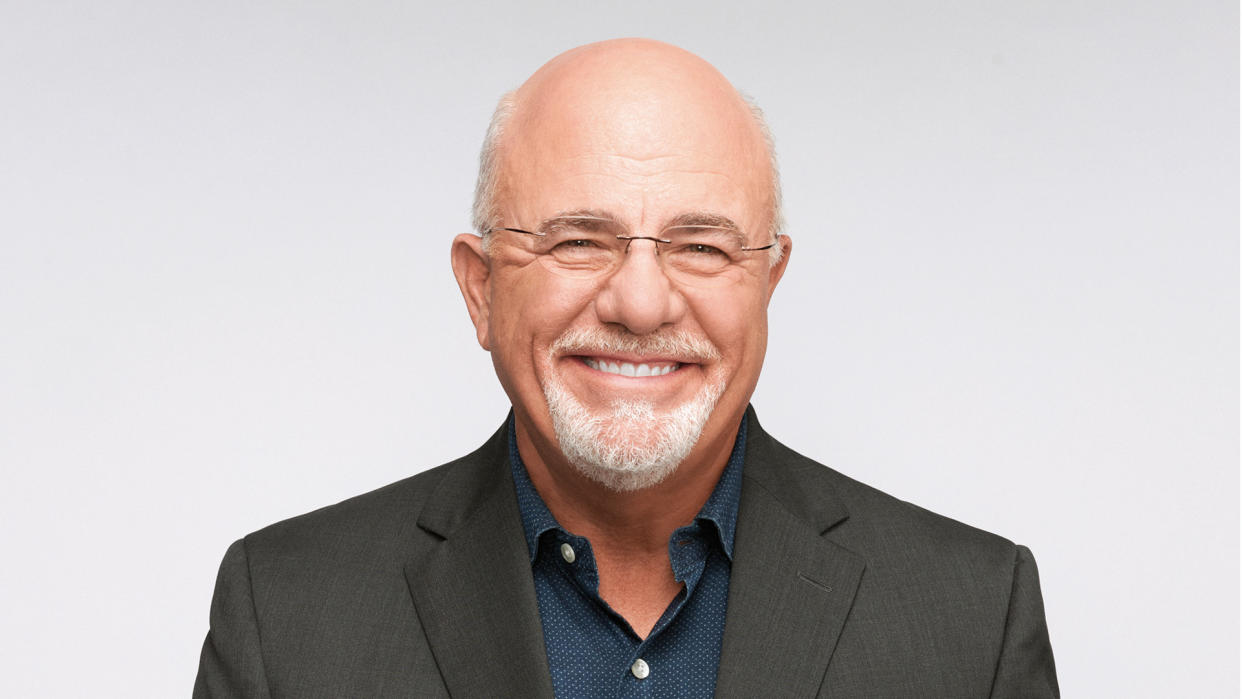

Dave Ramsey is one of the best-known financial experts in the country. His straightforward money advice has helped countless people get out of debt and find financial freedom. The talk radio personality turned podcast host is also a New York Times bestselling author. Millions of people follow him for his proven techniques for taking control of your money.

Check Out: Top Money Moves for Boomers, Gen X, Millennials and Gen Z

Read More: 6 Genius Things All Wealthy People Do With Their Money

A quick review of Ramsey Solutions can help you better prepare yourself to weather any financial hardships that may come your way. It will also help you learn how to save money and focus on reaching your financial goals. Here is Dave Ramsey’s best basic money advice to get you started.

Use the Debt Snowball Method

One of Dave Ramsey’s most talked about pieces of advice is using the debt snowball method. The snowball method is a proven debt reduction technique that can help you get your finances in order in a short amount of time.

The first thing you do with the debt snowball method is list your debts from smallest to largest without worrying about interest rates. Next, you make minimum payments on all debts except the smallest one. Put as much money as possible toward your smallest debt until it is paid off. Once it is paid off, take the same approach with the next smallest debt. Apply all of the money you were using to pay off the first debt toward the second one. Continue to do this until all of your debts have been paid off with the exception of your house payment.

The debt snowball method is effective because it is easy to follow and tangible. You see results fast because you tackle your smallest debts first.

Learn More: You Can Get These 3 Debts Canceled Forever

Be Aware: 5 Unnecessary Bills You Should Stop Paying in 2024

Create a Budget

Another common recommendation from Ramsey is to create a budget.

He explained, “Budgeting is the foundation you’ll build all the rest of your personal finance habits on top of.”

The first step to budgeting, according to Ramsey, is to write down all of your income. Next, you subtract all of your expenses. Third, you need to track your expenses. Finally, you can use the information to decide on a budget each month. Everything should be accounted for, including your “extras” or discretionary spending.

Discover More: 10 Expenses Most Likely To Drain Your Checking Account Each Month

Build a Starter Emergency Fund

As explained in Ramsey’s 7 Baby Steps, the first thing you should do to get your finances in order is to build a starter emergency fund. You should aim to save at least $1,000 in your starter fund to cover any unexpected expenses. Once you have completed your starter fund, you can work toward a fully funded emergency fund that should cover three to six months of expenses.

Invest In Your Retirement

In addition to paying off debt and saving for your emergency fund, Ramsey encourages people to invest in their retirements. He explains that saving for retirement is not as complicated as most people think.

He offers a four-step plan for retirement planning. The first step is setting your retirement goals. Next, you need to put aside 15% of your income. Third, he says to make sure you are investing for the long term. And finally, he recommends working with a financial advisor.

Skip the Buy Now Pay Later Method

While much of the advice that Ramsey offers is focused on the positive, he also shares cautionary tales about what not to do.

He warns people against signing up for a buy now, pay later method. He explains that the buy now pay later method is really just signing up for installment plans and “installment plans are just another form of debt.”

Learn More: 6 Things Minimalists Never Buy — and You Shouldn’t Either

Delete the Shopping Apps

Ramsey often speaks about the problem with impulse shopping and how smartphones have made it that much easier to get into debt.

He notes that individuals hoping to take control of their money need to “pay attention to (their) online spending habits.”

An easy way to break the habit is to remove temptation by deleting shopping apps from your phone.

More From GOBankingRates

Suze Orman: 5 Social Security Facts Every Soon-To-Be Retiree Must Know

Avoid These 7 Cars That Will Only Last You Half as Long as the Average Vehicle

The Biggest Mistake People Make With Their Tax Refund -- And How to Avoid It

This article originally appeared on GOBankingRates.com: Dave Ramsey’s Best Basic Money Advice To Get You Started